23 Lessons

3hours 30 minutes

500 enrolloed

💭 What If I Told You…

Your financial struggles aren’t because you don’t work hard enough—they’re the result of being trapped in the Employee & Self-Employed mindset.

But in this course, you can rewire your thinking, shift into the Investor & Business Owner mindset, and start building real financial freedom—without burnout, guilt, or endless hustle.

😨 Does you often expereince this?

❌ You work hard, but financial security still feels out of reach.

❌ You feel stuck trading time for money, with no real path to wealth.

❌ You were taught to “get a job and save,” but it’s not enough.

❌ You’re tired of paycheck-to-paycheck stress and not having money work for you.

👉 It’s NOT your fault. You were conditioned to stay in the rat race—but the good news? You can break free and rewire your mind for financial independence.

This course includes:

Lifetime Access

3 downloadable resources

1 valuable webinar

Certificate of completion

Master the Cashflow Mindset & Break Free

In just 4 hours you will accomplish the transformation journey to;

- Rewire your subconscious to shift from the Employee & Self-Employed mindset to the Investor & Business Owner mindset using proven neuroscience & financial principles.

- Break free from generational money patterns that keep you trapped in the rat race.

- Attract more wealth, opportunities, and financial freedom by thinking like an investor.

- Feel confident and secure building wealth without fear, guilt, or self-sabotage.

Course content

Cash flow refers to the movement of money in and out of a business or personal finances, determining financial health over time. The cash flow statement breaks down inflows and outflows, ensuring liquidity and sustainability. Effective management of inflows and outflows prevents crises, as cash flow stability matters more than income for long-term security.

The cash flow quadrant, originally coined by by Robert Kiyosaki, categorizes individuals into Employees, Self-Employed, Business Owners, and Investors, each with distinct traits.In this module you will learn the different characteritics of each module and you will identify where you currenlty belong.

Transitioning from one quadrant to another involves developing financial literacy, shifting mindsets, and taking calculated risks to build wealth and achieve financial independence.

Being rich means high income, while wealth is financial security and passive income. Wealth includes time freedom and control over assets. Managing risk, financial literacy, and networking lead to success in the Business and Investor quadrants.

Breaking free from financial struggles requires identifying poor money habits and adopting financial discipline. Business Owners and Investors enjoy greater financial security compared to Employees and the Self-Employed, who rely on active income. Understanding and shifting to more secure quadrants ensure long-term financial stability and independence.

Building personal assets reduces employment dependency. Success requires proactive investment decisions and cash flow management. In this module you will learn how to distinguish calculated risks from reckless actions prevents losses. Identifying the right investment style and seeking mentors accelerate financial growth.

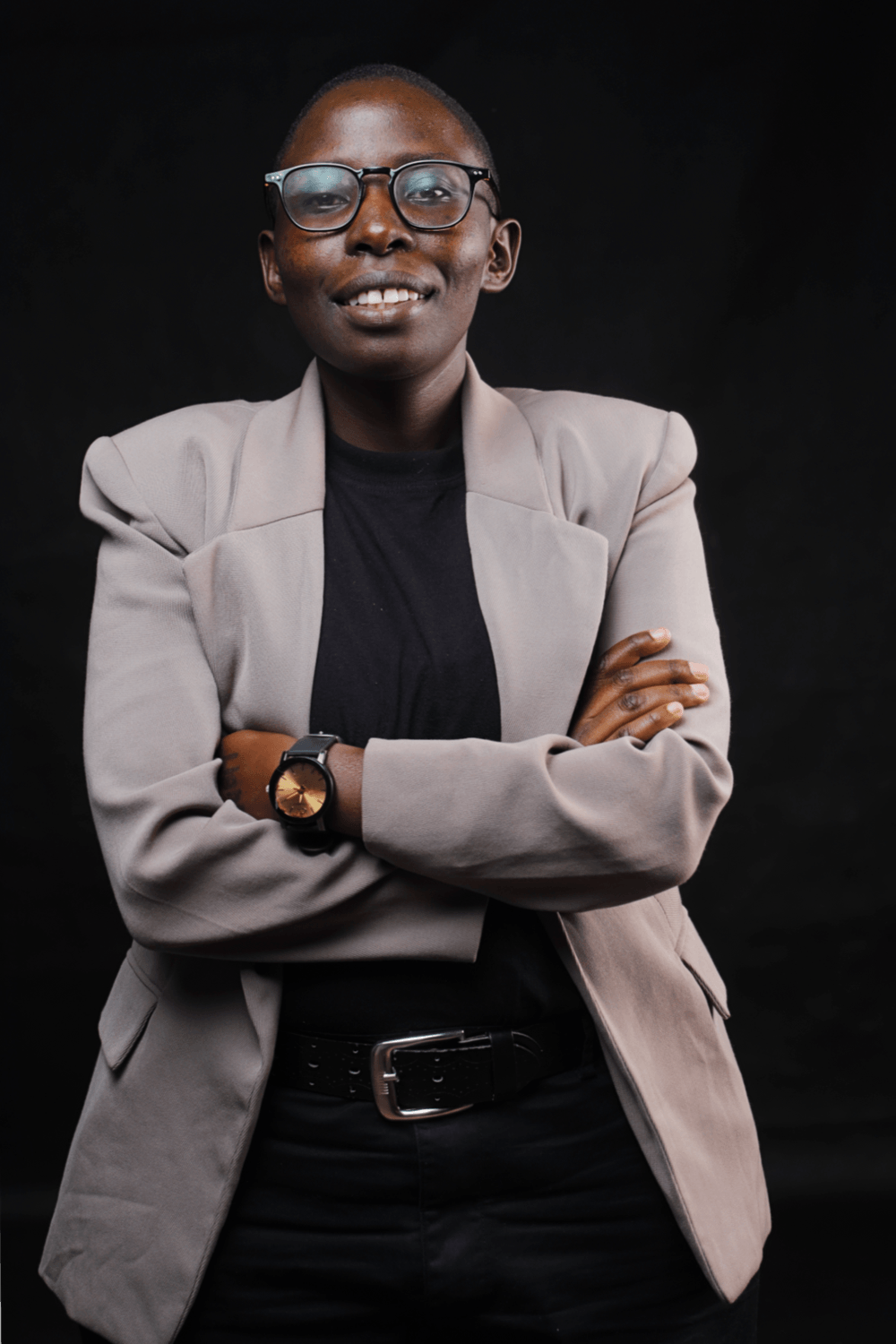

Meet the trainer

Charity founded wealth.edu, a financial literacy and advisory brand dedicated to empowering individuals to build wealth and enhance their financial performance.

As a CISI-certified financial advisor at Arvocap Asset Management, Charity specializes in wealth management and strategic financial planning.

With a deep commitment to guiding Millennials and Gen Zs toward financial independence, Charity created the Cashflow Mindset Course to help individuals break free from paycheck-to-paycheck cycles, develop wealth-building habits, and achieve lasting financial freedom.

Through expert insights, practical strategies, and a passion for financial education, the Cahsflow mindset course is here to equip you with the mindset and tools needed to take control of your finances and create a future of abundance.

Stop feeling stuck about money and start getting empowered.

Testimonial break;

"This course is well-researched and covers key investment concepts thoroughly. It triggered a deeper curiosity in me to explore more investment options. Even as someone familiar with finance, I found it valuable. Highly recommended for anyone looking to expand their investment knowledge!"

Gaylord

"This course is packed with valuable insights and well-structured for easy learning. The mix of videos and slides keeps it engaging, and the content is delivered clearly. It’s a great resource for anyone serious about financial growth. Definitely worth the investment!"

Linda Makatiani

Founder,Finance for Families

Ready to start the course?

Purchase the course below and begin your fiancial feedom journey

Got any questions?

email me :wealfyikigai@gmail.com